Introduction

Deflation, a sustained and widespread decline in prices, can have far-reaching consequences for an economy, affecting consumption, investment, and overall economic growth. While inflation tends to dominate economic discussions, deflation can be equally concerning and is often accompanied by its own set of challenges. China, as one of the world’s largest economies, has recently been grappling with the specter of deflation, raising significant concerns among policymakers and analysts alike.

The Deflation Paradox

Deflation might seem counterintuitive at first glance. After all, who wouldn’t want lower prices? However, when deflation becomes entrenched, it can trigger a vicious cycle that undermines economic stability. Consumers may postpone purchases in anticipation of even lower prices, leading to decreased demand for goods and services. As demand contracts, companies respond by cutting production and jobs, which, in turn, reduces consumer spending further. This cycle can result in a downward spiral, stalling economic growth and potentially leading to recession.

China’s Deflationary Pressures

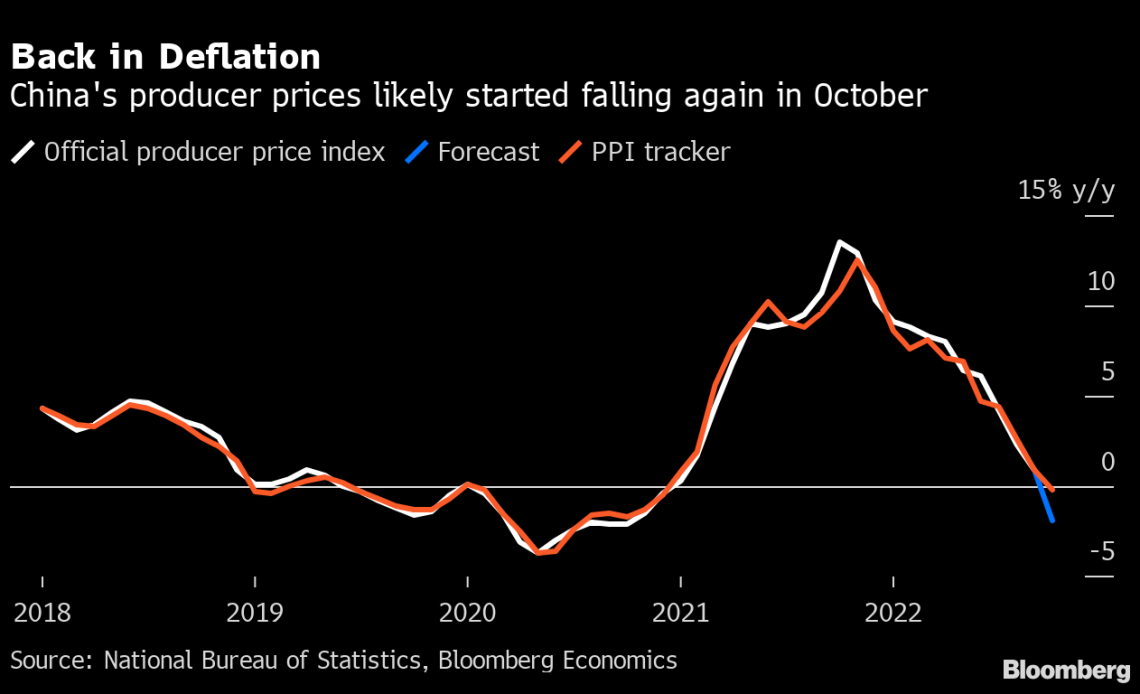

In recent years, China has been experiencing a slowdown in economic growth, driven by factors such as trade tensions, demographic changes, and shifts in global supply chains. These challenges have contributed to deflationary pressures within the Chinese economy. Notably, China’s Producer Price Index (PPI), which measures the average change in selling prices received by domestic producers for their output, has shown persistent declines, reflecting weakening demand and excess capacity.

Several key factors contribute to China’s deflationary environment:

- Overcapacity: China’s rapid industrialization over the past few decades has led to excess capacity in various industries, such as steel and manufacturing. This excess supply can drive prices down as producers compete to sell their products, leading to deflation.

- Falling Demand: Trade tensions and shifting consumer preferences have contributed to a decrease in demand for Chinese exports. Reduced demand can lead to lower prices as businesses seek to attract customers.

- Demographic Shifts: China’s aging population and declining birth rates have implications for consumer spending patterns. An older population tends to save more and spend less, which can contribute to weaker demand and deflationary pressures.

- Debt Burden: China’s corporate debt levels have risen significantly in recent years. High levels of debt can constrain consumer spending and hinder business investment, further dampening demand and contributing to deflation.

Policy Responses and Concerns

To counter deflationary pressures, China’s central bank and policymakers have taken various measures, such as lowering interest rates, implementing targeted stimulus packages, and encouraging lending. While these actions aim to stimulate economic activity, there are concerns about the potential side effects:

- Risk of Asset Bubbles: As interest rates are lowered and liquidity is injected into the economy, there is a risk that excessive lending could lead to the formation of asset bubbles, such as in the real estate market. These bubbles could burst and trigger financial instability in the long term.

- Debt Accumulation: Expanding lending to combat deflation may lead to a higher accumulation of debt, which could weigh on the economy’s long-term health and stability.

- Effectiveness of Monetary Policy: In a deflationary environment, conventional monetary policy tools, such as interest rate cuts, may have limited effectiveness. This challenges policymakers to find innovative and targeted approaches to stimulate demand.

Conclusion

While falling prices might seem beneficial on the surface, deflation carries its own set of risks and challenges. China’s experience with deflationary pressures underscores the complex interplay of economic factors that can lead to a downward spiral of weak demand, reduced investment, and slower growth. Policymakers face the delicate task of stimulating demand without triggering adverse consequences such as asset bubbles or unsustainable debt levels. As China navigates these challenges, the global economic community will be closely watching the country’s efforts to maintain economic stability and sustainable growth in the face of deflationary pressures.